Facing pressure from lenders or recovery agents?

You don’t have to navigate legal notices and financial stress alone. We help you find a structured, lawful way forward.

Facing pressure from lenders or recovery agents?

You don’t have to navigate legal notices and financial stress alone. We help you find a structured, lawful way forward.

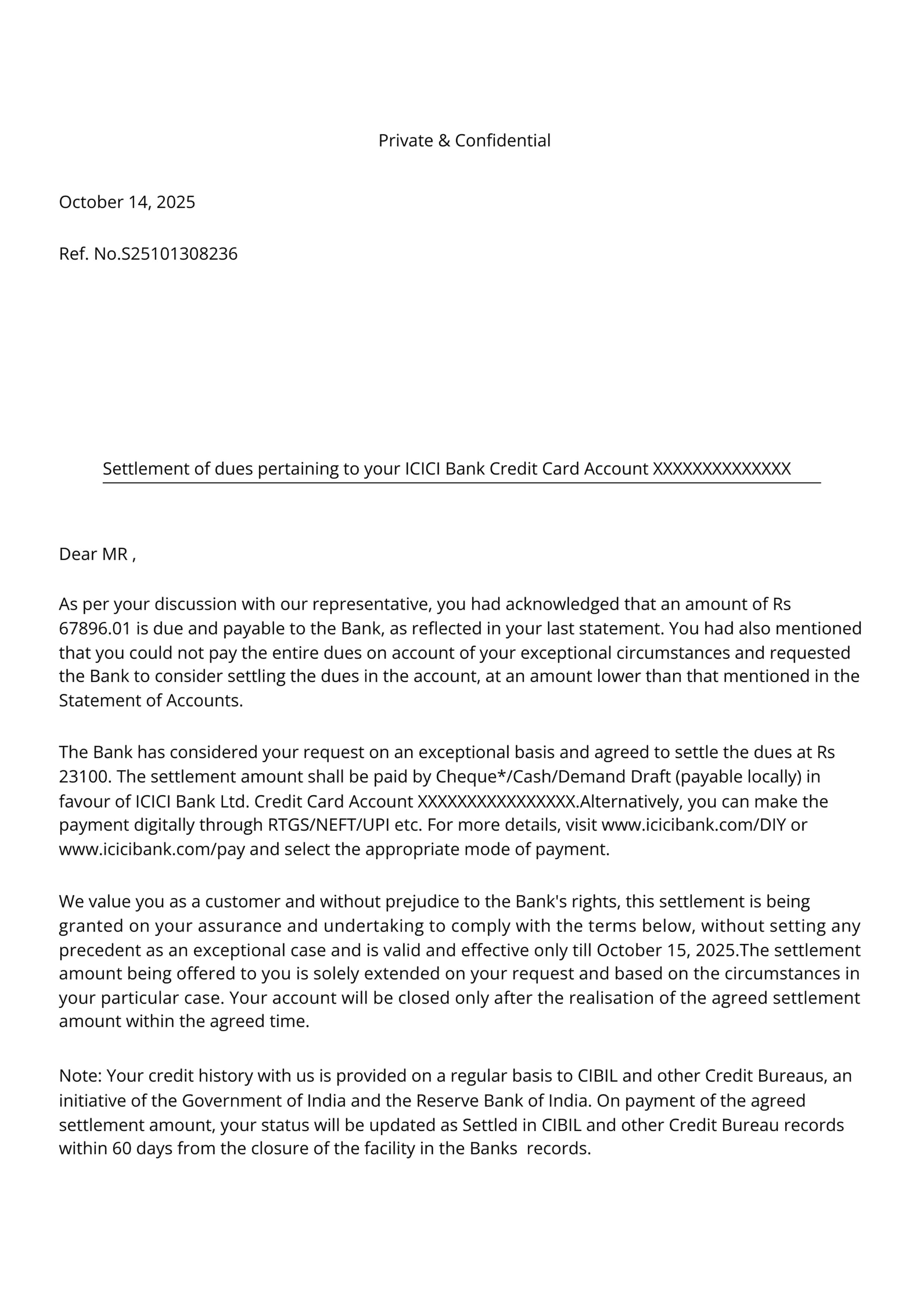

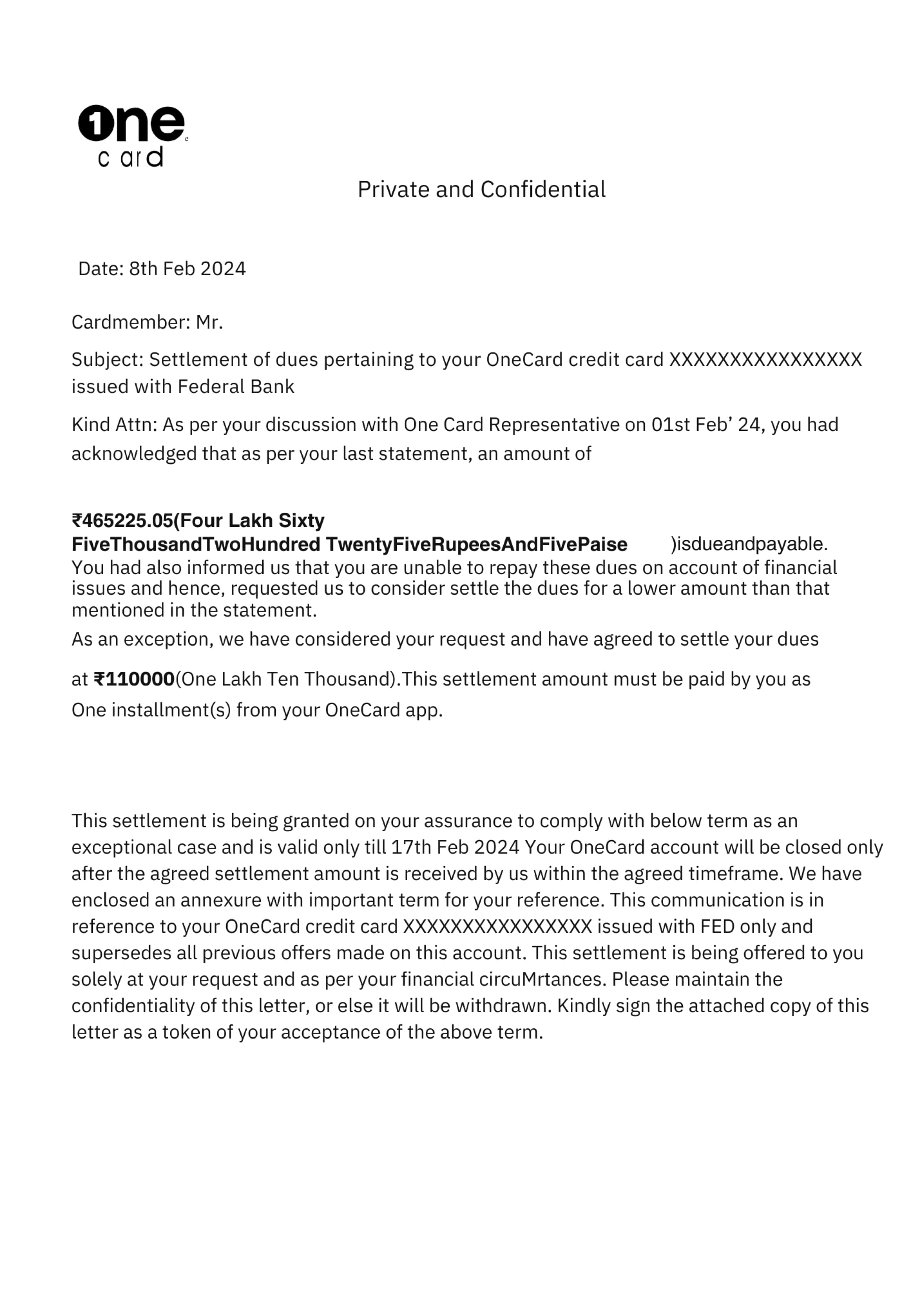

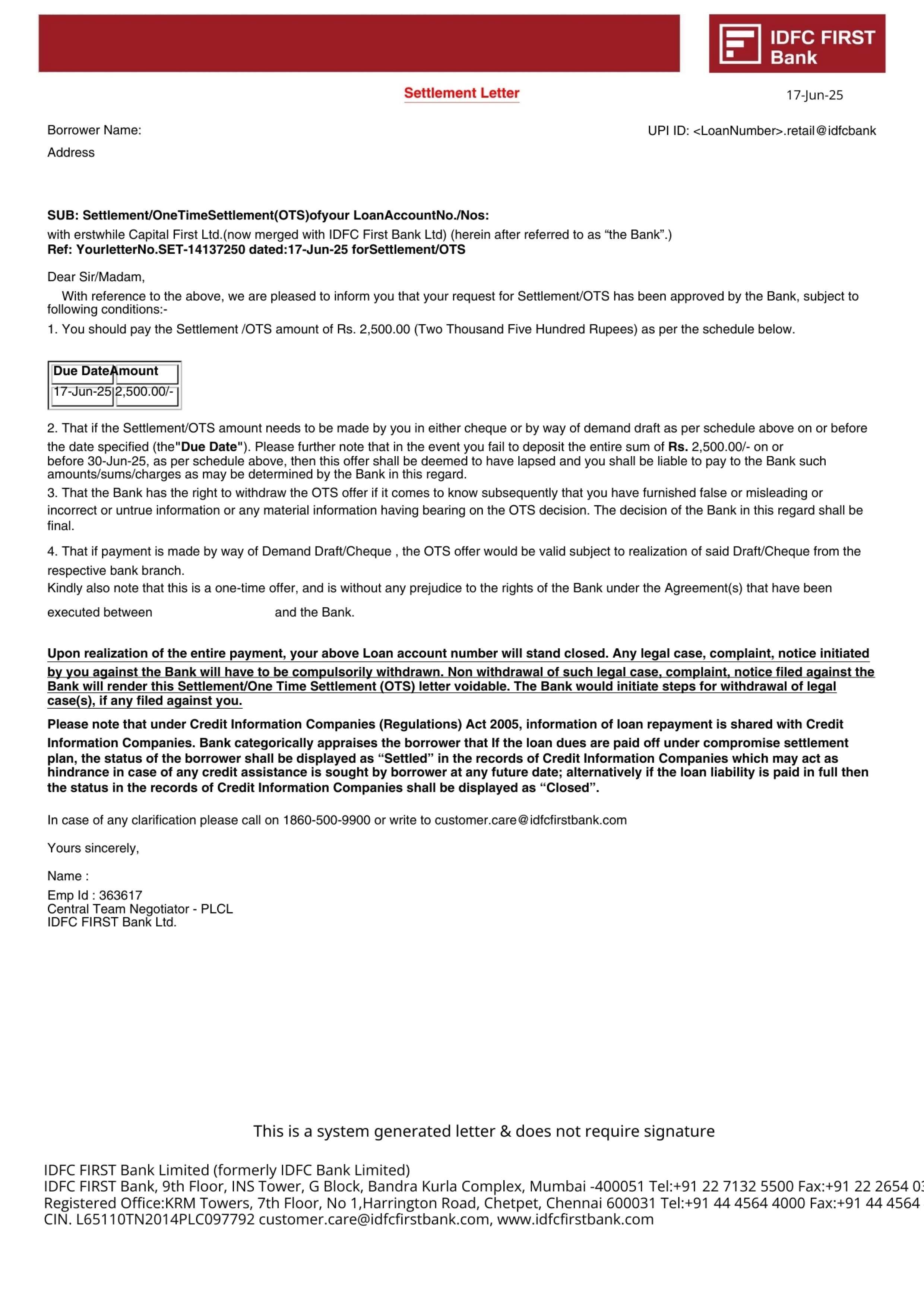

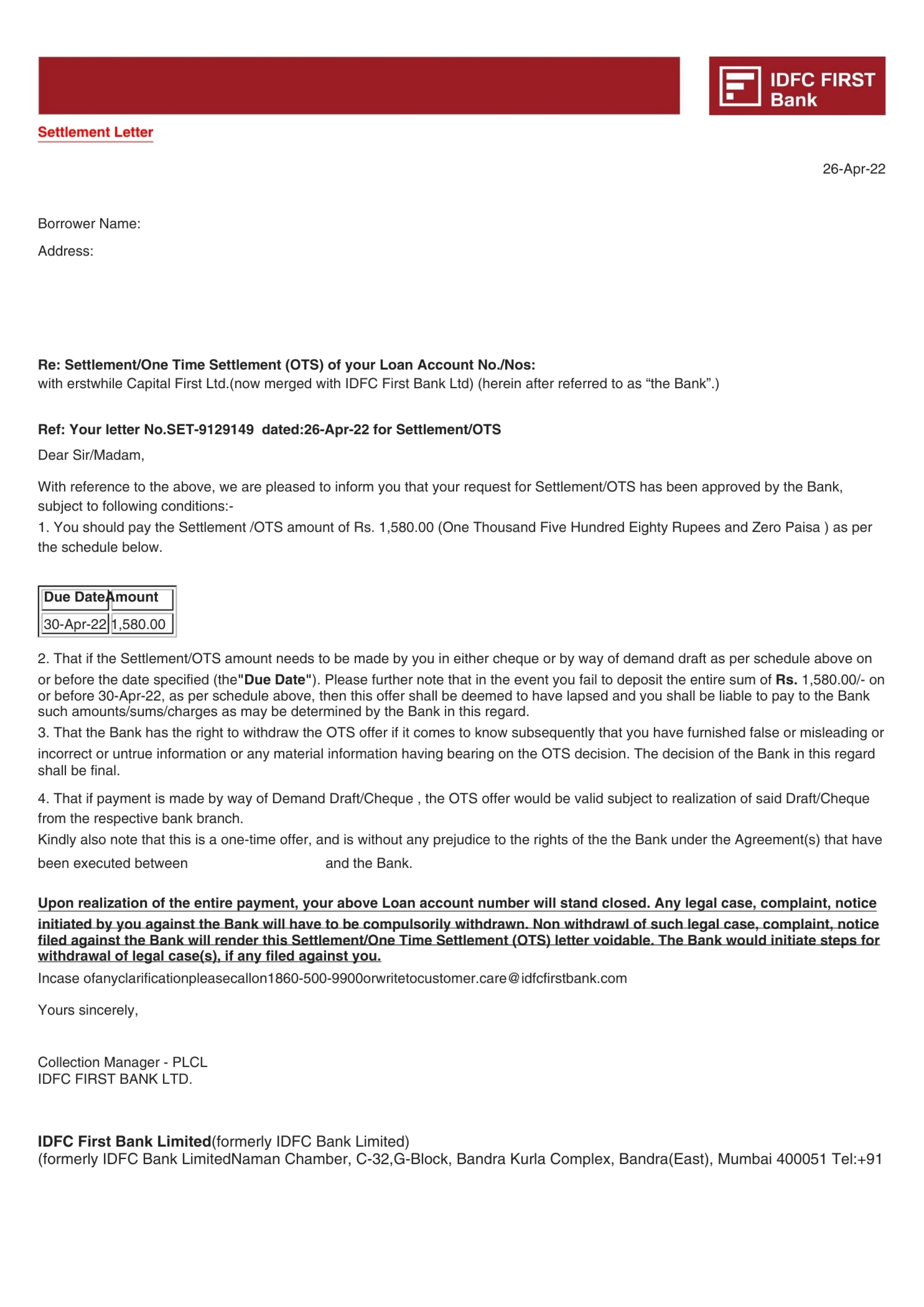

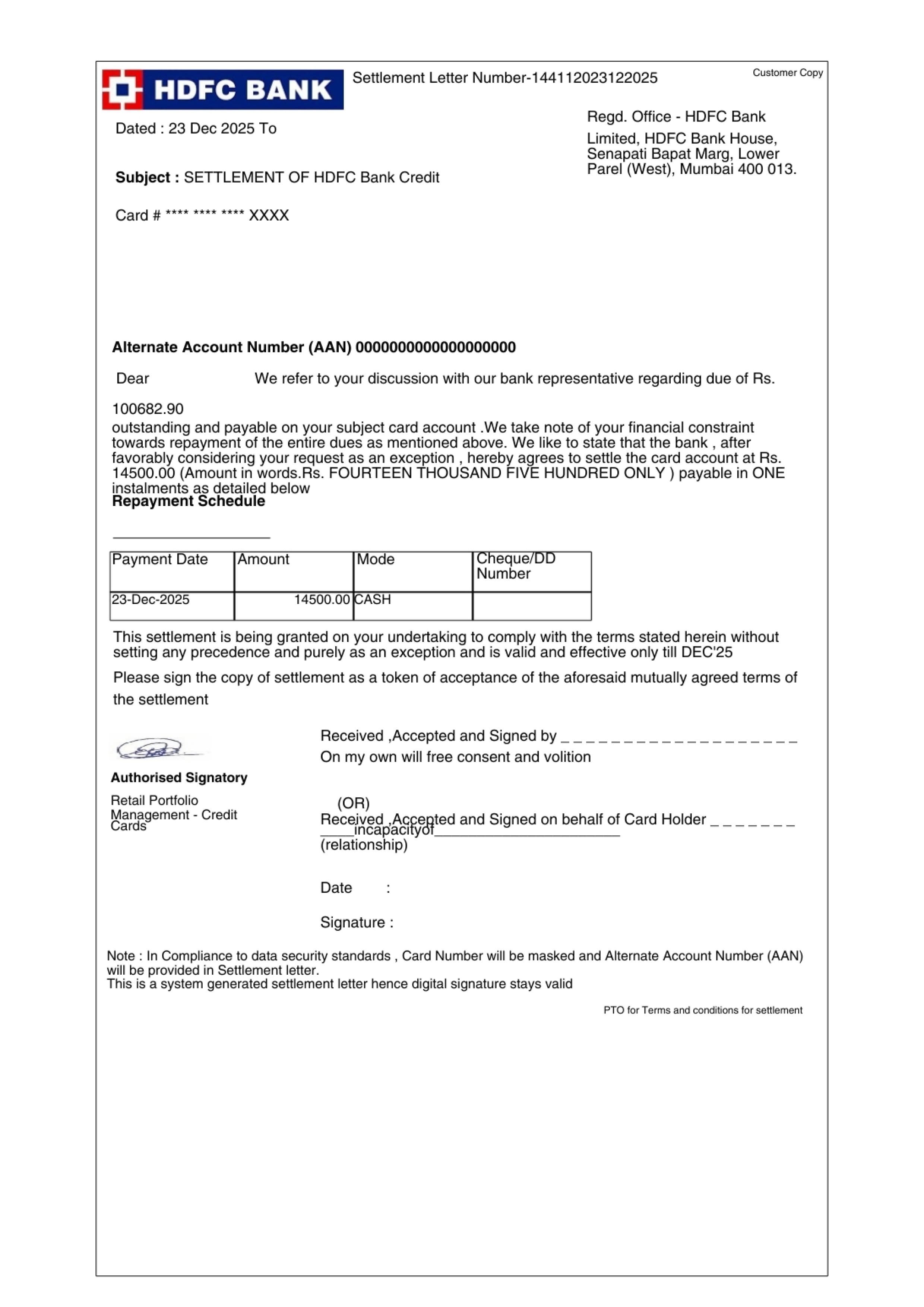

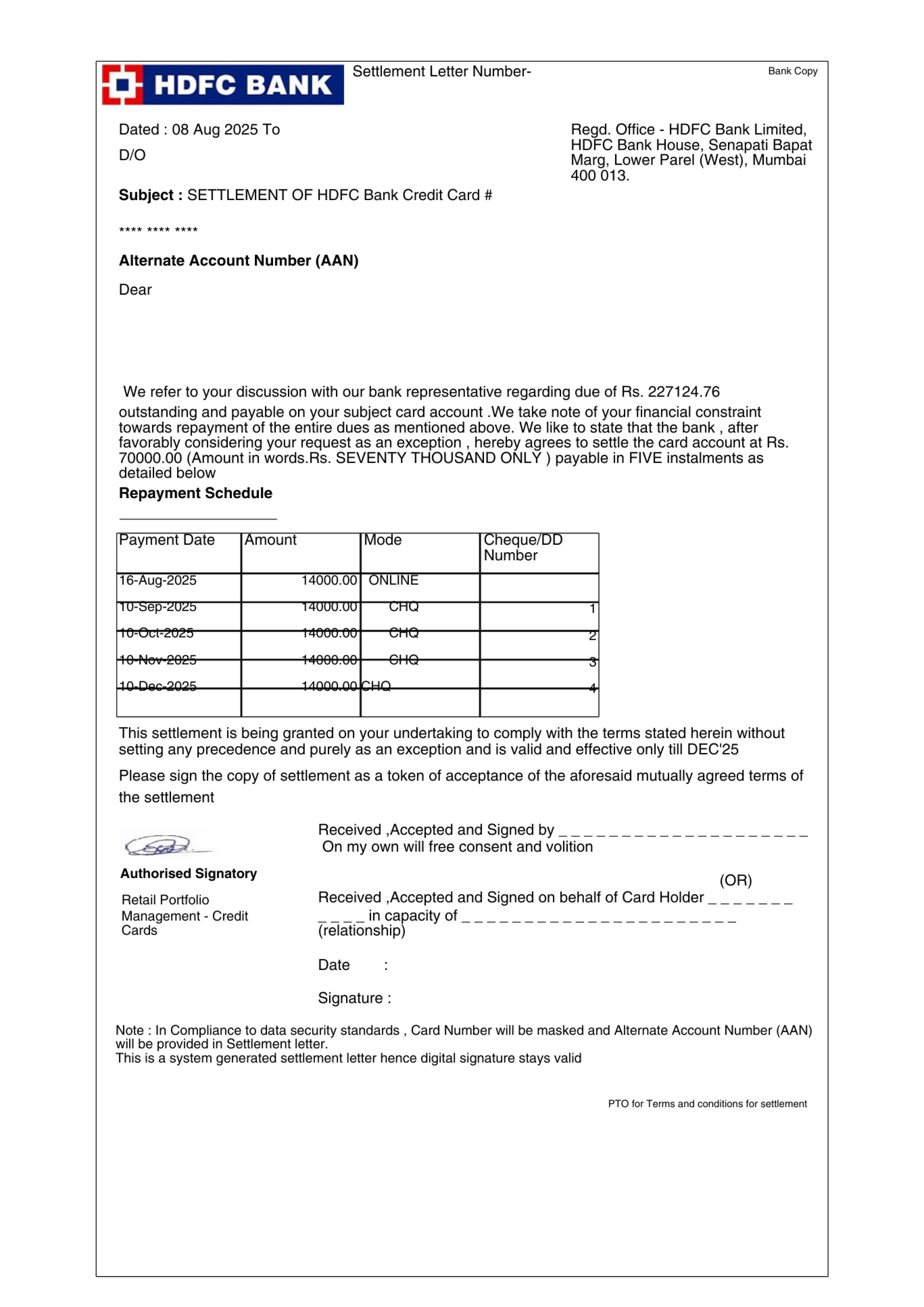

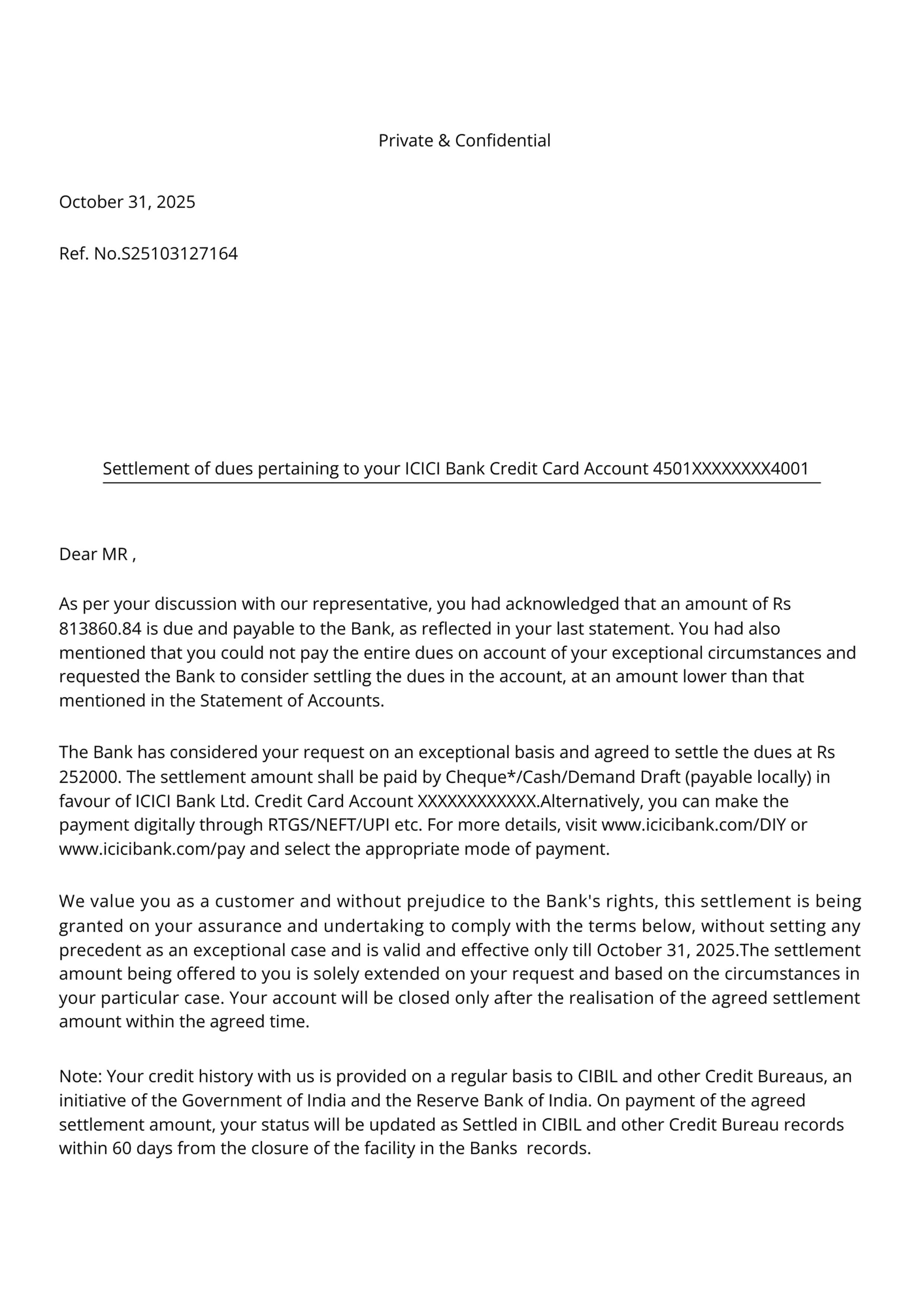

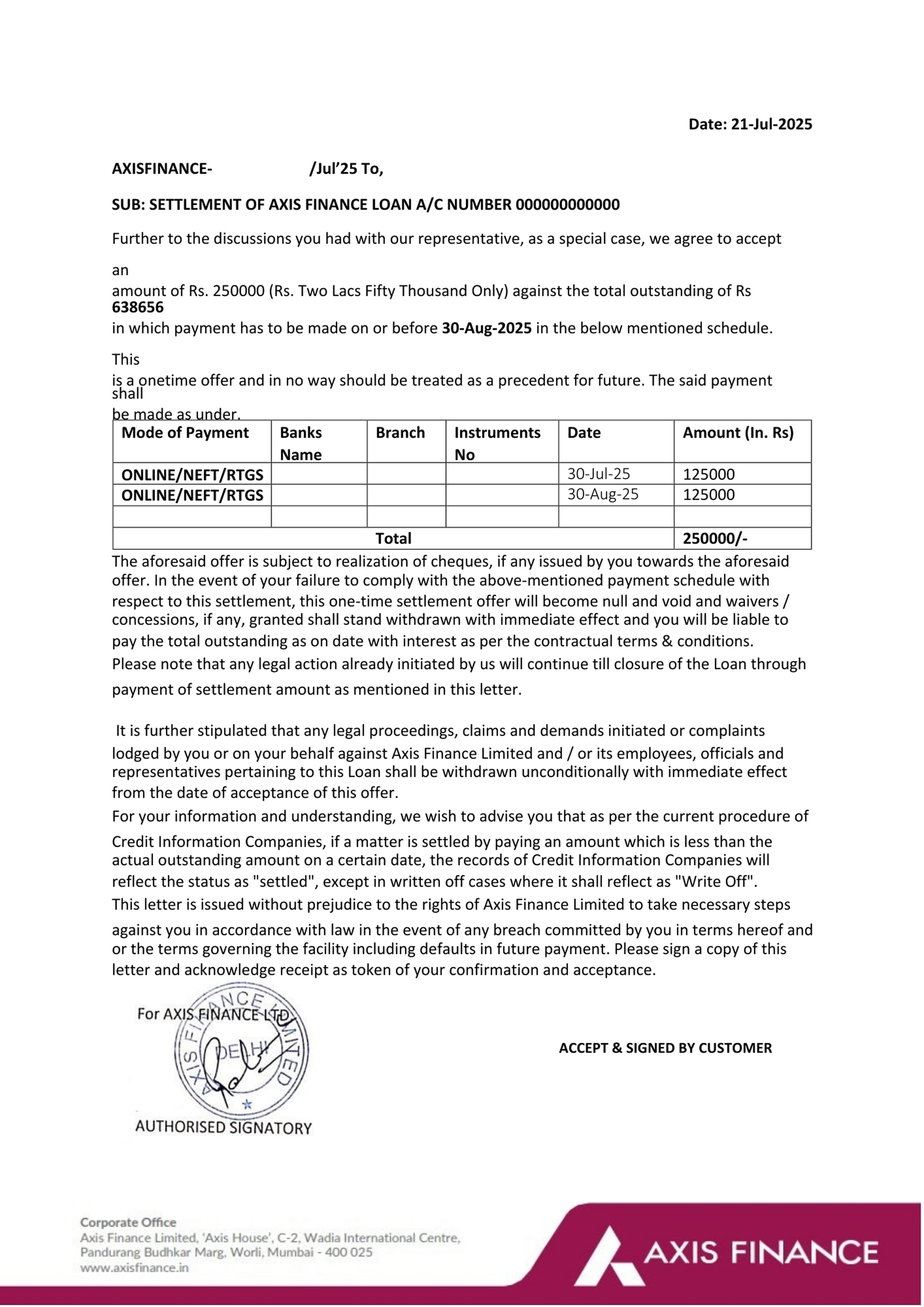

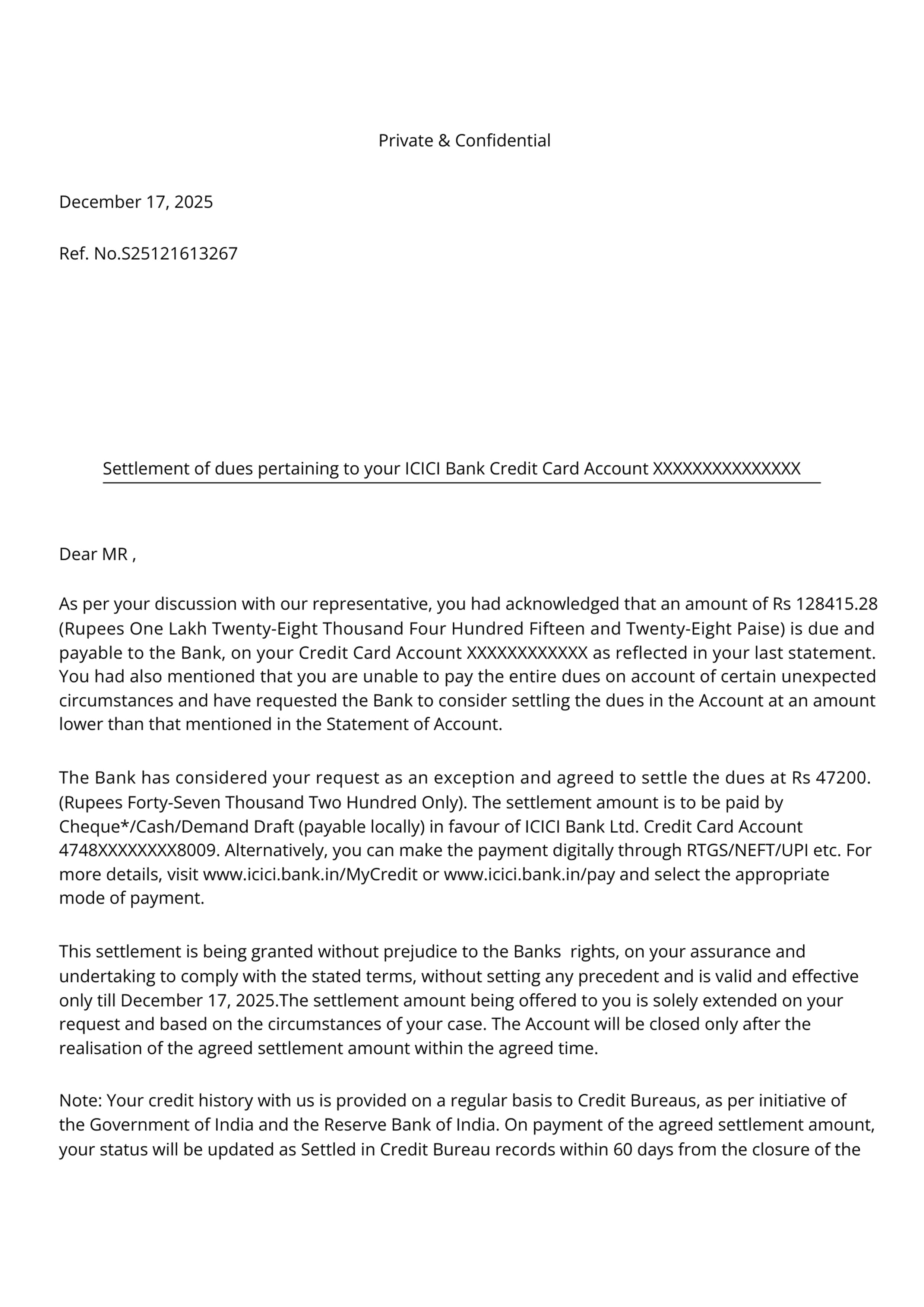

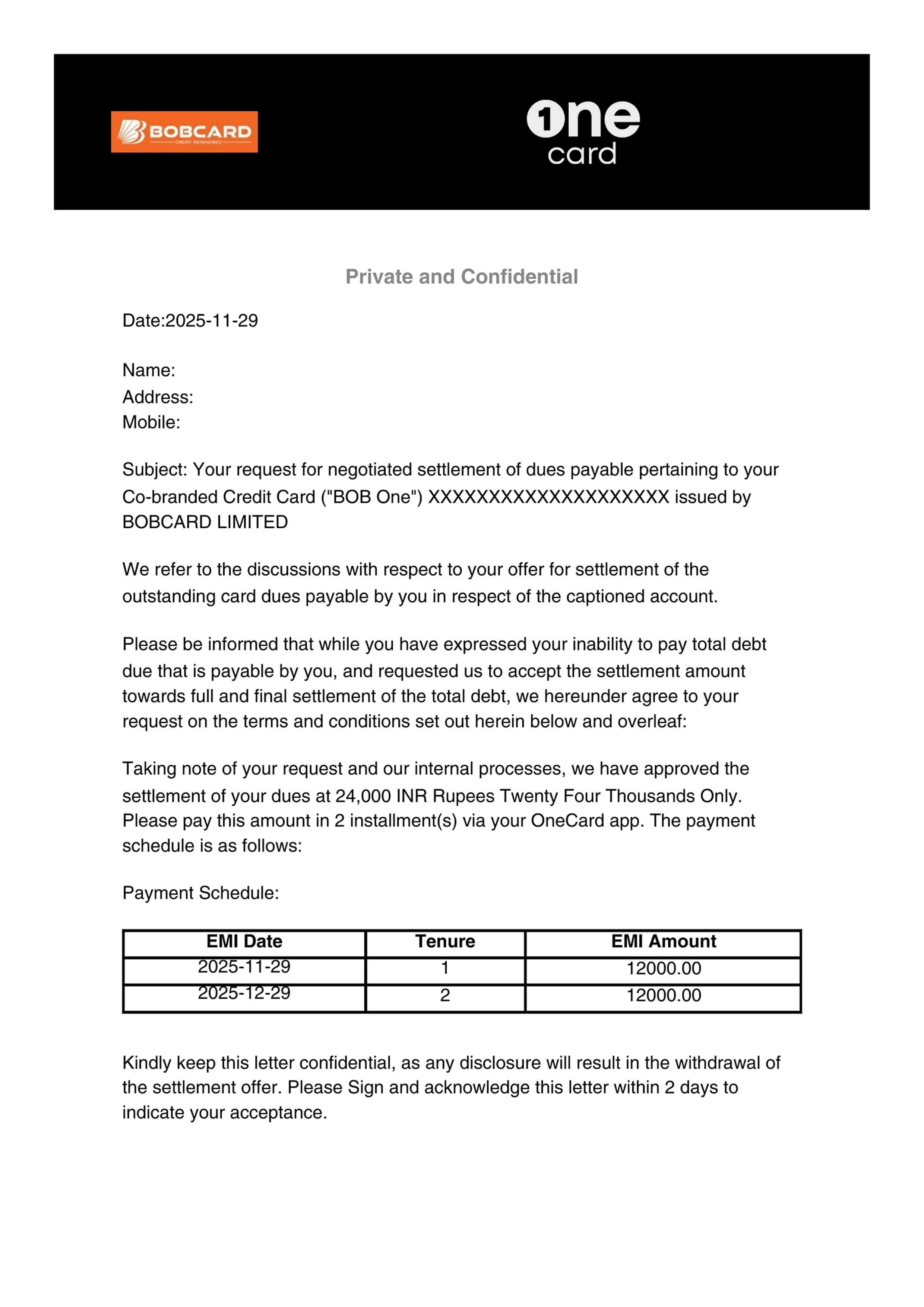

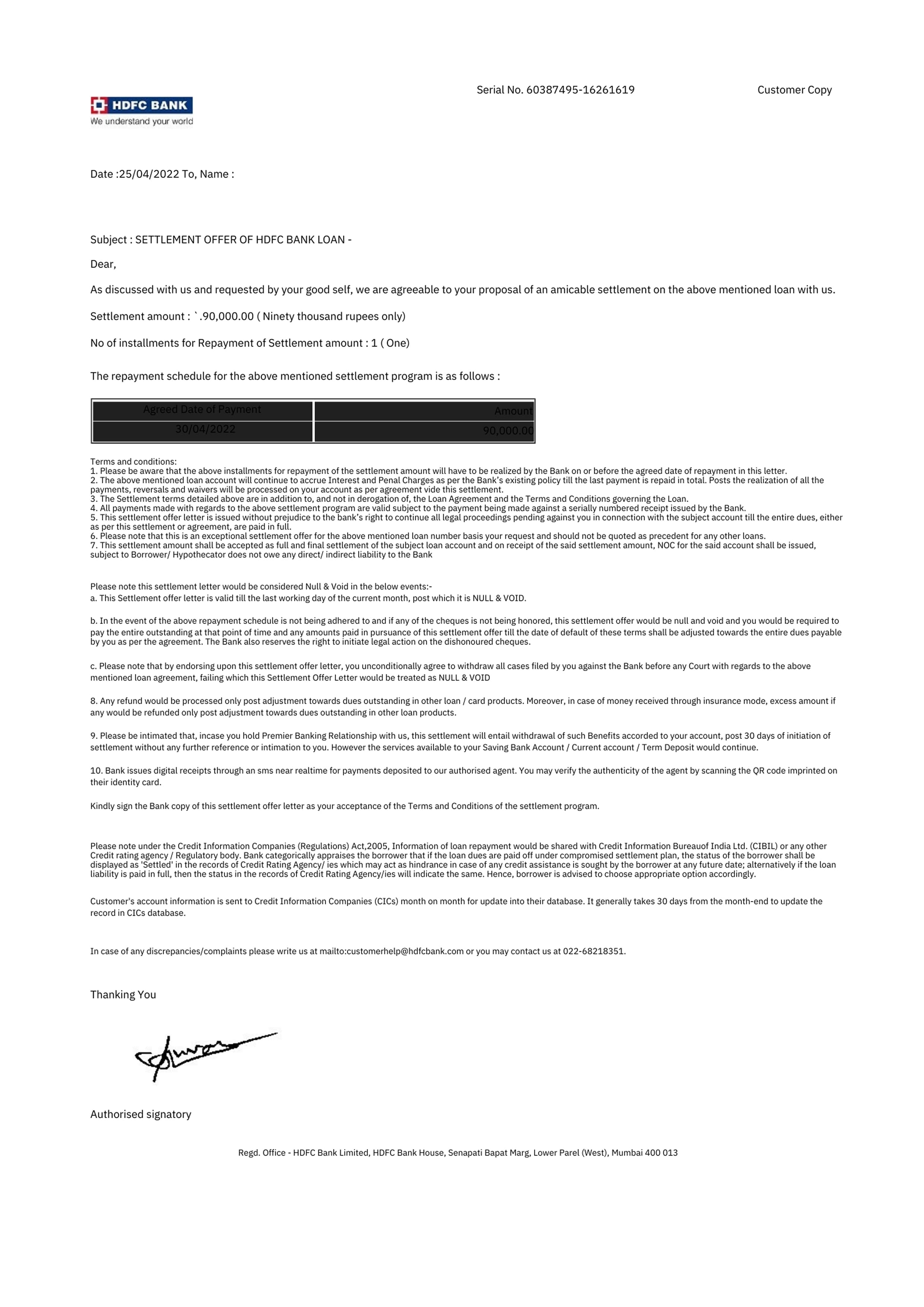

Real Settlements.

Real Results.

Explore verified settlement letters from clients who’ve successfully resolved their loans with SettleLoans.

Settlement,

Backed by Process

A secure, compliant system built to deliver real outcomes at every stage.

Direct Lender Negotiation

We engage directly with banks and recovery teams to craft settlement terms tailored to your case.

Verified Settlement Records

Receive documented settlement letters issued by lenders not just verbal confirmations.

Credit Recovery Guidance

We guide you on rebuilding your credit profile after resolution for long-term financial stability.

Legal-Backed Process

Every settlement follows a structured, lawful process aligned with lender policies and regulatory standards.

Dedicated Case Manager

A single expert guides your case from start to closure.

Trusted by Thousands to Resolve Loans with Confidence

End-to-end settlement solutions designed to reduce stress, protect your rights, and guide you toward verified loan closure.

Select Your Bank For

Specialized Settlement

Each bank has unique settlement policies and OTS frameworks. Select your bank below to learn the exact step-by-step process we use to settle their debts.

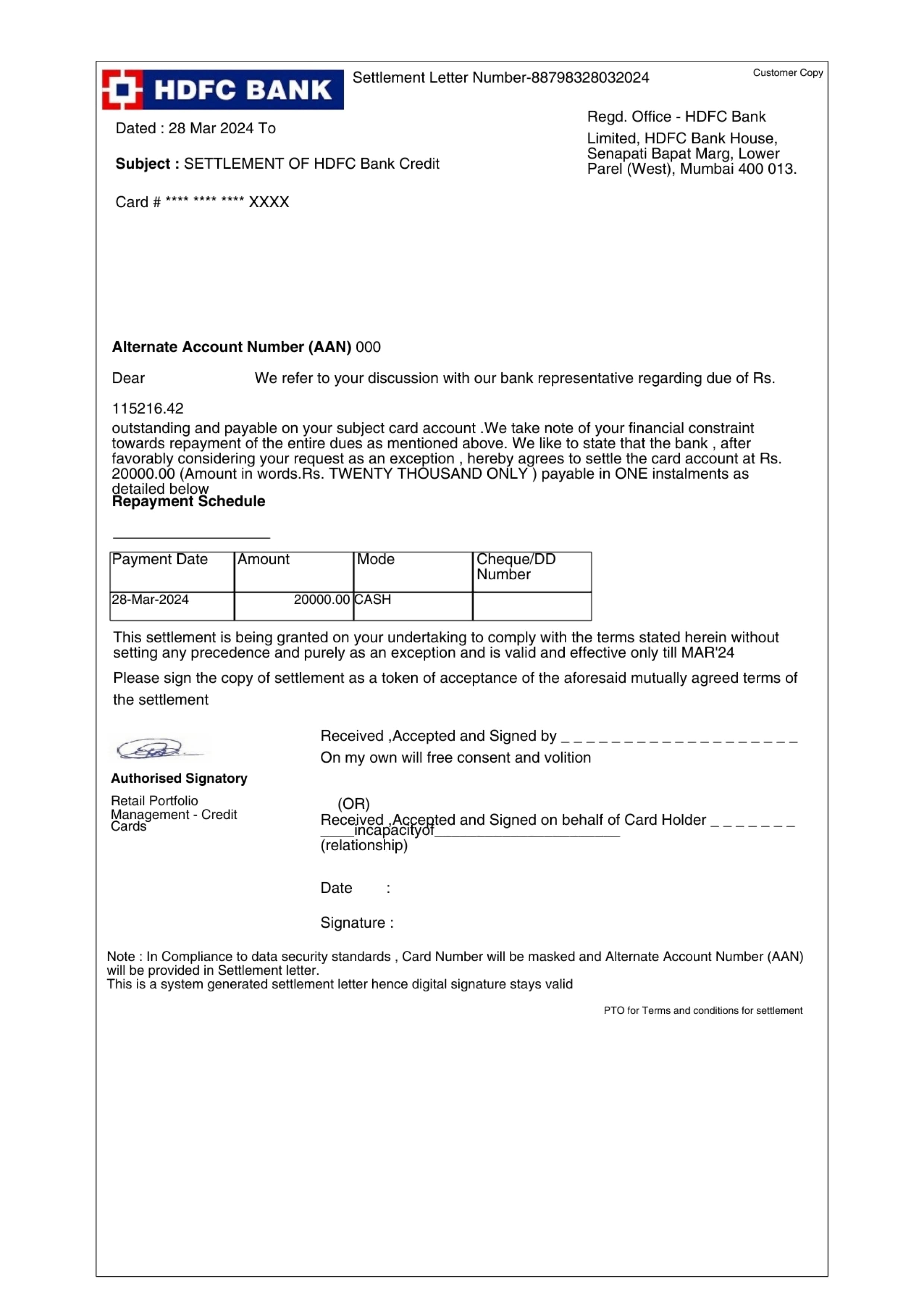

HDFC Bank

Settle credit cards and personal loans with HDFC Bank.

Axis Bank

Professional help for Axis Bank debt settlement.

SBI Bank

The definitive guide to SBI loan and card settlements.

ICICI Bank

Expert settlement for ICICI credit cards and loans.

Kotak Mahindra

Resolve Kotak credit card and loan debts.

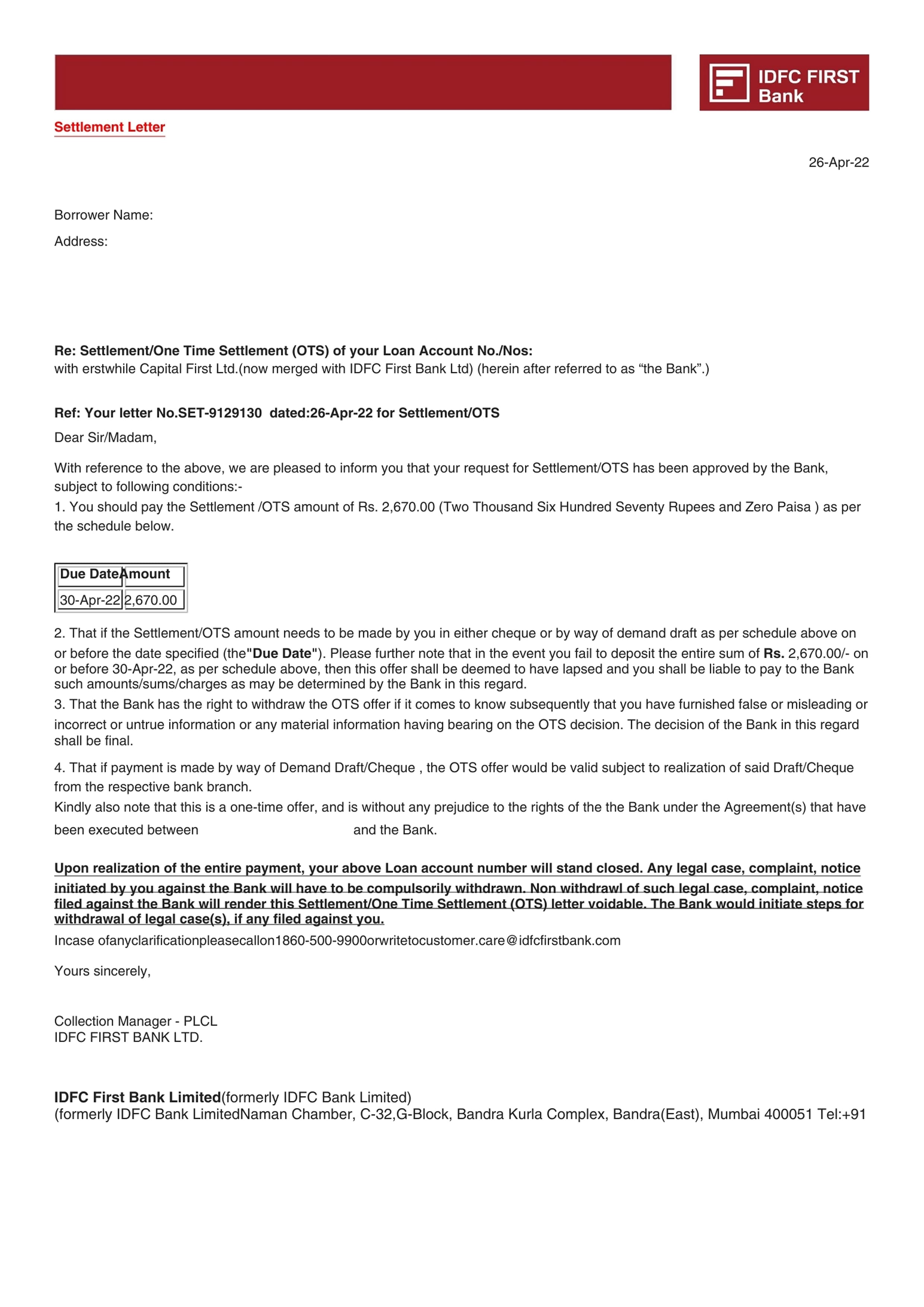

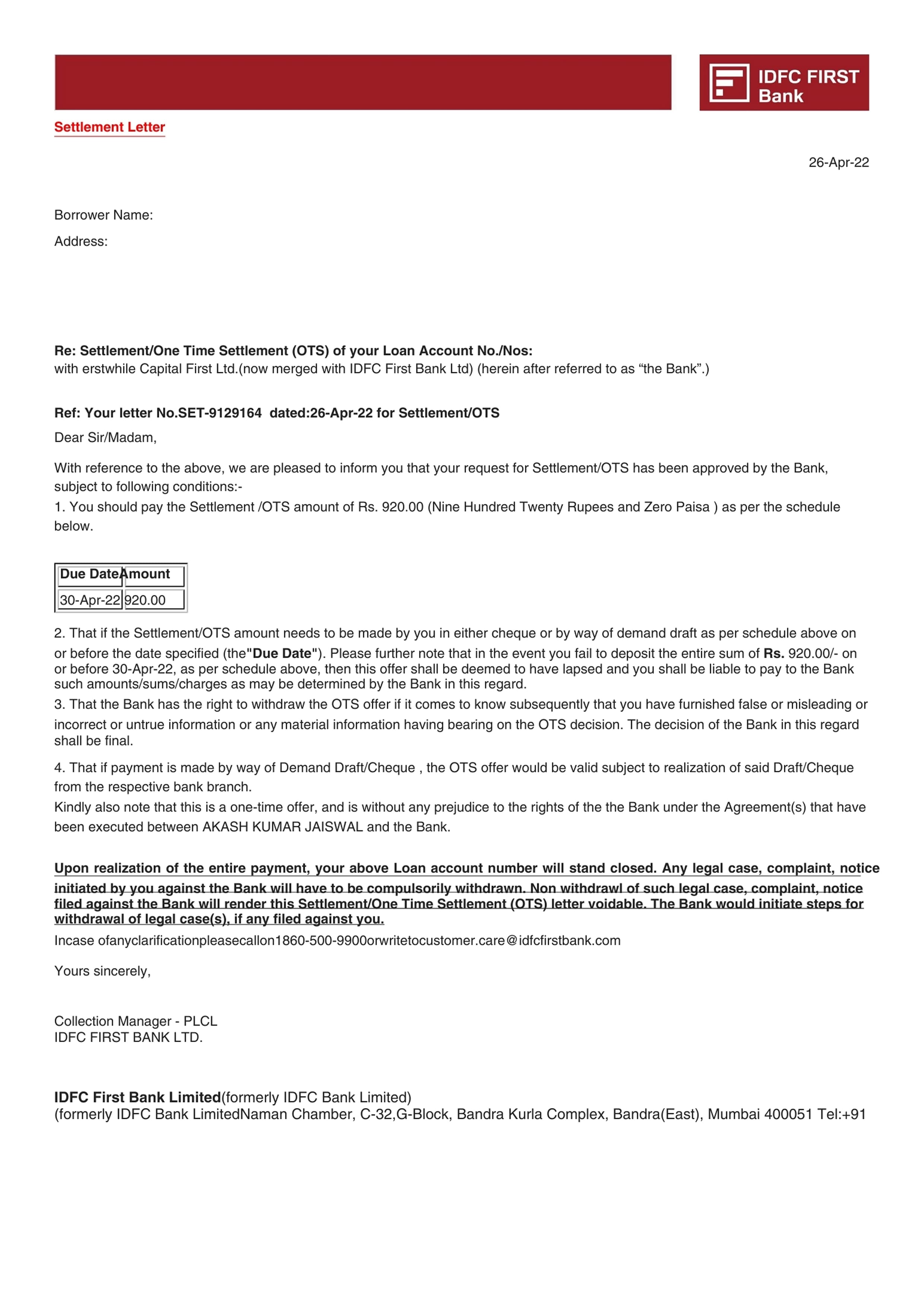

IDFC First Bank

Strategic settlement for IDFC personal loans.

RBL Bank

Professional settlement solutions for RBL Bank debt.

YES Bank

Expert guidance for YES Bank and J.C. Flowers ARC settlements.

IndusInd Bank

Navigate IndusInd personal loans and credit card settlements.

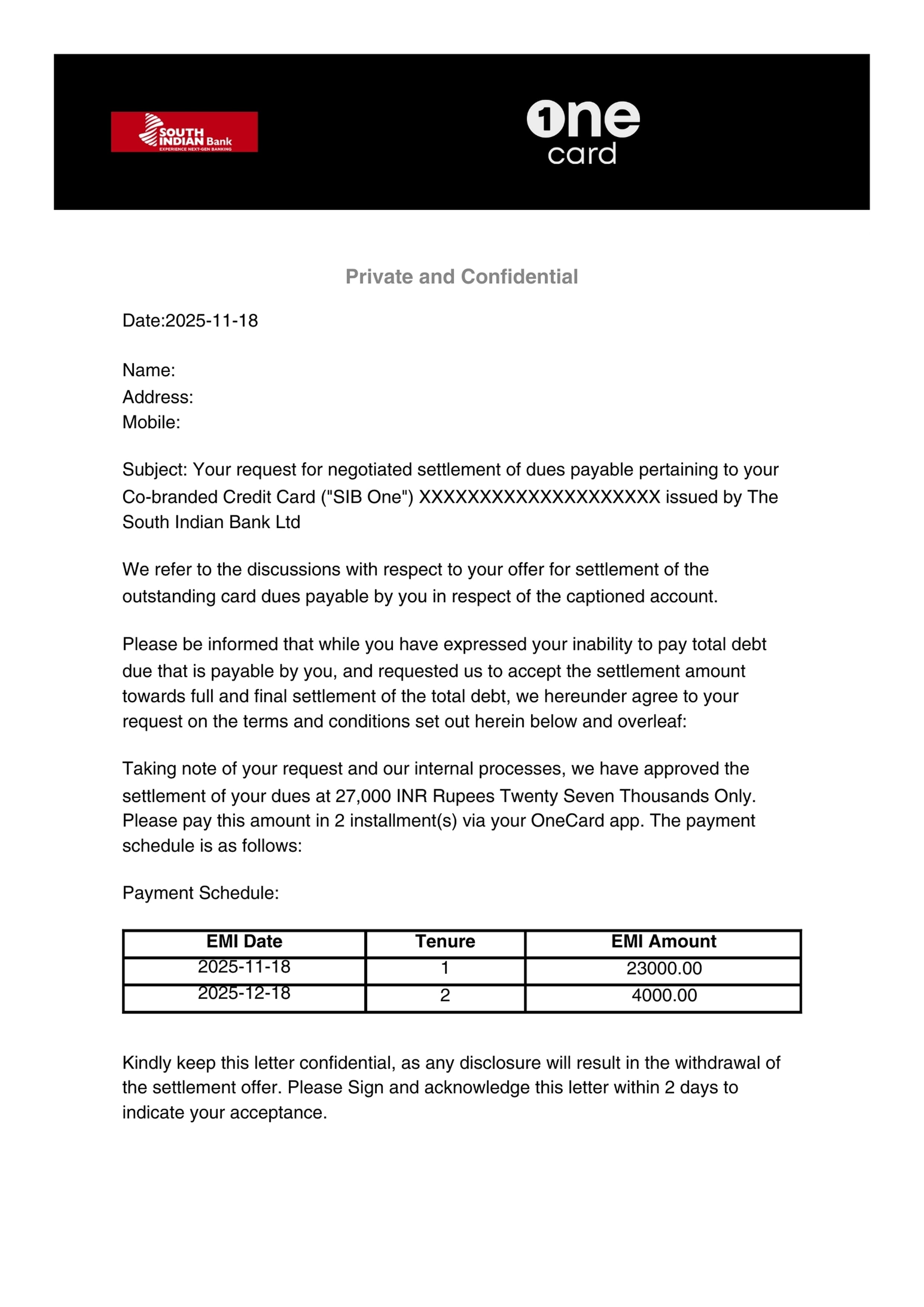

Kisetsu Saison Finance

Specialized OTS strategies for Credit Saison India app loans.

Bajaj Finance

Settle Bajaj Finserv personal loans and SuperCard dues.

Fibe

Expert settlement for Fibe (EarlySalary) personal loans.

Don't see your bank? We settle loans for almost all major Indian banks and NBFCs.Inquire More →

Frequently Asked

Questions

Clear answers to help you understand our process, pricing, and what to expect at every step.

100+ Successful Settlements

Last Month

.png&w=3840&q=75&dpl=dpl_CRB7nvzPtdJhWJMZD823nUdrS3Ja)